Inaccurate Information Common

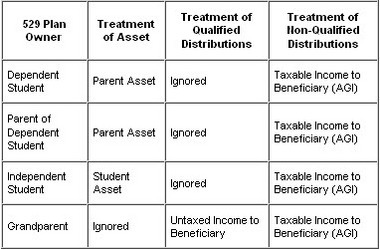

Many web sites, including those of a few 529 plan administrators, contain inaccurate information about the impact of a grandparent-owned 529 plan on eligibility for need-based financial aid. These web sites often incorrectly state that grandparent-owned 529 plans have no effect on financial aid eligibility. The misinformation is surprisingly persistent. Here are a few examples of such errors: There's also an interesting strategy if you have relatives who want to contribute to your child's education: A grandparent or someone else can open a 529 plan in their name, with the child as beneficiary, instead of depositing money in your plan. Since the contributor "owns" the account, it has zero impact on FAFSA financial aid calculations. ... accounts that are owned by a grandparent have no impact when determining eligibility for financial aid on the FAFSA, and the value of a 529 plan is generally excluded from the grandparent’s estate. Another attractive feature of 529 plans is that under current law, grandparent-owned 529 accounts are excluded by the federal government’s financial aid formula — only parent-owned 529 plans count. So a grandparent-owned 529 plan won’t impact a grandchild’s chances of qualifying for federal aid.

Q: I’m considering a 529 plan for my grandchild but will I hurt my grandchild’s chances of receiving financial aid?To help debunk this misinformation, this article documents the treatment of 529 plans as encoded in the statute and subregulatory guidance.

A: 529 accounts owned by grandparents (or other non-parent) are not reportable as an asset on the FAFSA financial aid application. ... Grandparent owned 529 accounts are not counted in determining financial aid eligibility; all the more reasons for grandparents to make gifts to their grandchild’s 529 plan.