As the cost of college continually rises, and often outpaces the rate of inflation, many average, everyday families are wondering, "How do people afford college?" Although winning a huge scholarship to cover the full cost of college is ideal, it's not the reality.

Fortunately, there are more realistic ways to pay for college.

How Does the Average Family Pay for College?

The average family likely doesn't have a huge

college savings account that will cover the full cost of tuition. It may cover a year or two, but in addition to saving for college, the average family has been paying a mortgage or rent, bills, and saving for retirement.

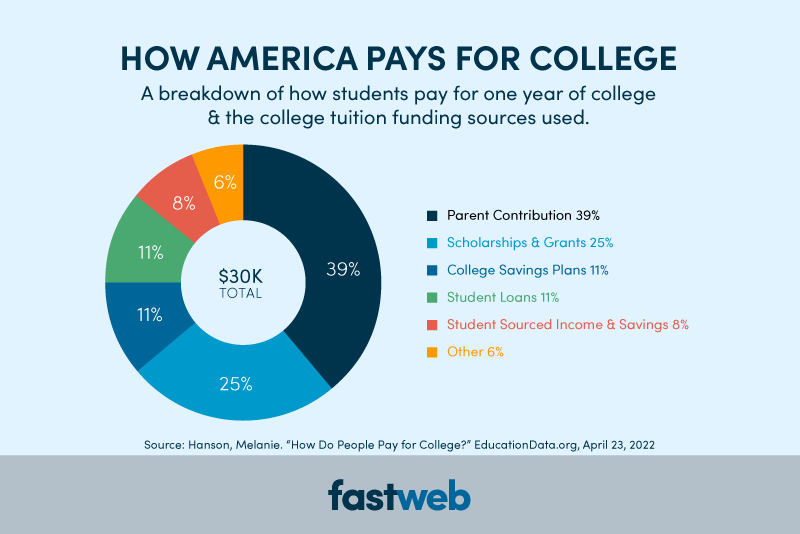

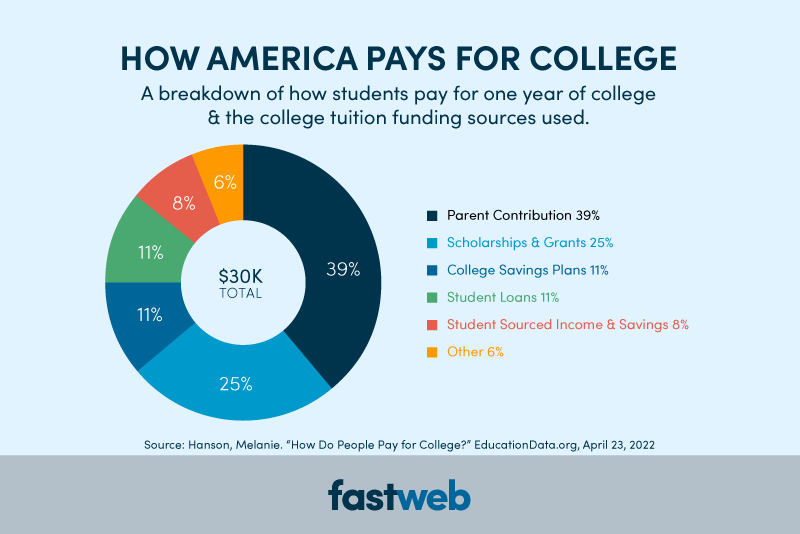

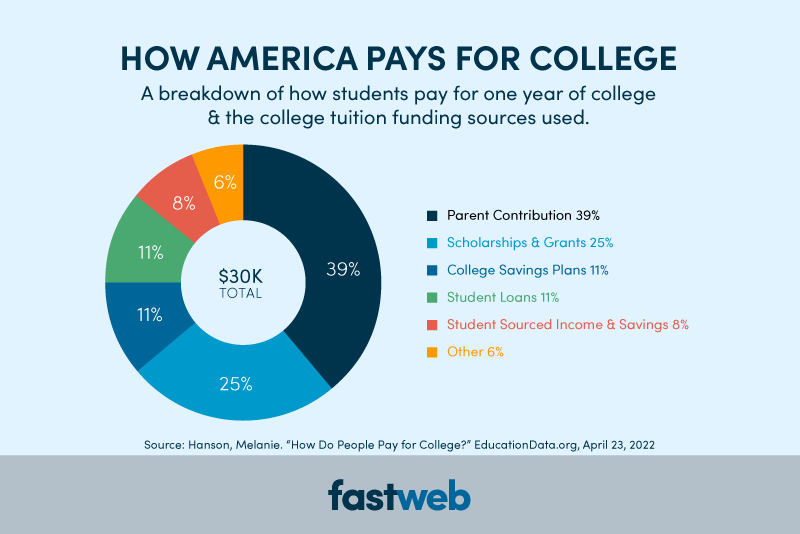

As families make a plan to pay for college, they need to strategize. This means they can't rely heavily on a single resource. Instead, Americans pay for college by exploring a variety of tuition funding sources.

College Tuition Funding Sources

The average family uses a few – or all – of the following to

pay for college:

•

Scholarships and Grants – Free money that does not have to be paid back.

•

Financial Aid – Distributed by the government and/or colleges and comes in the form of grants, work study, or student loans.

•

Private Student Loans – Money that you have to pay back after graduation.

•

College Savings – Any money saved before or while the student is enrolled in college.

•

https://www.fastweb.com/career-planning/internships">Part-Time Jobs and Internships – Money received from paychecks can help cover tuition costs.

•

Education Tax Benefits – Credits received for being enrolled in college.

College Scholarships and Grants

Scholarships and grants are forms of free money that help pay for college, and they never have to be repaid. You can qualify for scholarships and grants simply by applying to college.

Many colleges and universities will offer merit aid when they send you an acceptance letter. You do not need to fill out separate applications for merit scholarships or grants. Instead, the amount is determined by the information you provide on your college application, including your GPA, test scores, and extracurricular activities.

You can also search for scholarships and grants with sites like

Fastweb. We host a variety of scholarships, including national, institutional, and local scholarships, within our database. All you have to do is fill out a profile on our site, and we'll match you to scholarship opportunities that you qualify for.

College Financial Aid

Financial aid is defined as grants, work-study, and federal student loans. To receive financial aid, you must first qualify, which is achieved by completing the Free Application for Federal Student Aid (FAFSA).

The

FAFSA becomes available on October 1, and you're encouraged to complete this form as soon as possible. Many states and schools distribute financial aid on a first-come, first-served basis.

Financial aid packages will typically include multiple forms of aid. Grants do not require repayment. Work study allows you to work a student job on campus, and your paychecks can be used to pay for tuition or other expenses, like meals off campus, books, etc.

Finally, federal student loans may be part of a

financial aid package. This is money that is lent to you to cover your college expenses, and it must be repaid after graduation. If you do need student loans to cover the cost of attending college, federal loans are the best because they have lower interest rates than private student loans.

Private Student Loans

Often, there is a gap between the scholarships and financial aid available and the actual costs of college. To bridge this gap, many students take out private student loans.

Private student loans should be used as a last resort to avoid excessive borrowing for your education. When it is time to borrow, you can look at

loan providers through Fastweb or ask your financial aid office for their preferred lender list. This is a list of lenders with which they have previously worked.

College Savings

Although financial experts will urge you to start saving for college as soon as your children are born, you can start saving at any time. Even if you only manage to save a few hundred dollars before school starts, a dollar saved is a dollar less that students will have to borrow.

Parents of college-bound students can open a

529 savings plan. This type of savings account offers tax benefits and financial aid advantages, making it a secure way to save for college.

However, there is one caveat: The

529 savings plan should be in the parents' names and not the student's. When it comes time to fill out the FAFSA, a student's assets are scrutinized more closely than those of their parents. A 529 savings plan could be counted against a student, whereas it wouldn't be the case if it were counted as a parent's asset.

Part-Time Jobs and Paid Internships

Many students opt to work a part-time job or use money from a paid

internship to cover college costs, like tuition or student expenses. While scholarships and financial aid have to go to designated costs, money from your jobs can be used for anything.

Furthermore, some employers have begun offering their part-time employees

tuition assistance. Although there are stipulations regarding where you can use the tuition assistance, many have expanded their networks to include local and nationally recognized colleges and universities.

Walmart, Chipotle, and UPS are just a few of the

companies offering employee tuition assistance.

Education Tax Credits

There are tax credits you can claim each year simply for being enrolled in college:

•

Lifetime Learning Tax Credit – Up to $2,000 per year can be claimed for being enrolled in any continuing education courses or programs. This ranges from PhD programs to career development courses.

•

American Opportunity Tax Credit – Up to $2,500 can be claimed for up to four years by students seeking a degree, certification, or other recognized credential.

Though you cannot claim both

education tax credits at the same time, a household is permitted to claim both tax credits for different family members each year. For instance, if a child is enrolled in college and a parent is taking continuing education courses, the parent can claim the Lifetime Learning Tax Credit and the student can claim the American Opportunity Tax Credit in the same year.

Should Parents Pay for College?

As families prepare to pay for college, many ask a tricky question: How much do parents contribute to college costs?

Whatever decision your family makes, the government believes it is the parents' responsibility to pay for college. That's why they ask for parental financial information on the FAFSA and any other supplemental forms. The only way out of this scenario is to qualify as an

independent student, which is extremely difficult to do.

However, just because the federal government considers it the parents' responsibility doesn't mean it works that way for every family.

EducationData.org shares that 39% of students pay for all of their college expenses, 32% pay for none, and 29% pay for some.

Ultimately, families must decide what works best for their family, and they should utilize as many college tuition funding sources as possible, such as those mentioned above. Have

conversations about who is paying for college sooner rather than later, i.e., before senior year. Using a

college cost calculator, and with college costs and payment expectations in place, students and their parents can make more informed decisions about college choices and finances.

Paying for College: Common Mistakes

As students and parents strategize how to pay for college, it's important to avoid common mistakes.

First and foremost, complete the FAFSA. It’s the first line for qualifying for financial aid. Neglecting to

complete the FAFSA means not qualifying for certain scholarships, grants, and other forms of financial aid, and over half of all students do not submit the form.

Another common mistake is not applying for scholarships and grants. Many students limit their scholarship search to their

senior year of high school. Applying for scholarships earlier and continuing the search through college will mean more opportunities to qualify for and win scholarships.

Finally, families should start

saving for college as soon as possible, whether it's starting at birth or during the senior year of college. It's never too late – or to early – to start saving.

Many colleges and universities will offer merit aid when they send you an acceptance letter. You do not need to fill out separate applications for merit scholarships or grants. Instead, the amount is determined by the information you provide on your college application, including your GPA, test scores, and extracurricular activities.

You can also search for scholarships and grants with sites like Fastweb. We host a variety of scholarships, including national, institutional, and local scholarships, within our database. All you have to do is fill out a profile on our site, and we'll match you to scholarship opportunities that you qualify for.

Many colleges and universities will offer merit aid when they send you an acceptance letter. You do not need to fill out separate applications for merit scholarships or grants. Instead, the amount is determined by the information you provide on your college application, including your GPA, test scores, and extracurricular activities.

You can also search for scholarships and grants with sites like Fastweb. We host a variety of scholarships, including national, institutional, and local scholarships, within our database. All you have to do is fill out a profile on our site, and we'll match you to scholarship opportunities that you qualify for.