The FAFSA will be launching soon, and all students will have access to the form. However, some districts have been able to complete the form ahead of time thanks to the beta testing, and now the beta testing FAFSA is available to all who would like to participate.

Beta testing of the FAFSA ensures that any bugs or discrepancies are flagged and corrected before the form goes live for all students. These students do not have an advantage over others when it comes to financial aid distribution. They are simply filling out the form early to help the Department of Education manage any issues before the official launch.

Fortunately, beta testing allows for opportunities to preview the FAFSA. Below is a parent’s perspective on completing the beta version and their experience filing the FAFSA for the first time.

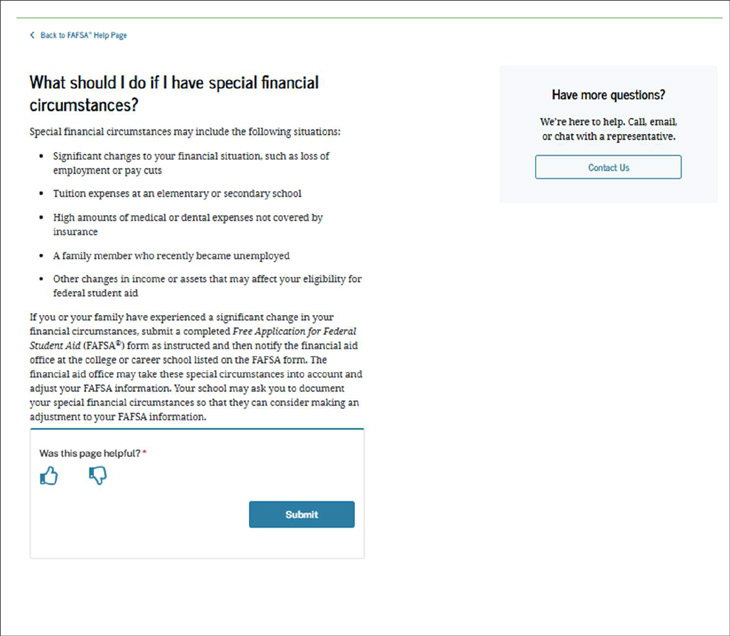

If you’re a parent who needs help completing the FAFSA, there are multiple resources available to you. First, you can visit the StudentAid.gov Help section and chat with Aiden, their virtual assistant. You can also chat, email, or call the Federal Student Aid Information Center. Interpreters for 10 different languages are available to assist with conversations in these languages.

Finally, many schools and communities host FAFSA completion workshops. These special days enable students and parents to walk through the form with a FAFSA expert.

If you’re a parent who needs help completing the FAFSA, there are multiple resources available to you. First, you can visit the StudentAid.gov Help section and chat with Aiden, their virtual assistant. You can also chat, email, or call the Federal Student Aid Information Center. Interpreters for 10 different languages are available to assist with conversations in these languages.

Finally, many schools and communities host FAFSA completion workshops. These special days enable students and parents to walk through the form with a FAFSA expert.

Parents Filing the FAFSA

The Free Application for Federal Student Aid (FAFSA) is a form that all students must complete if they hope to qualify for financial aid. Even if students and families don’t feel like they would qualify, it’s still helpful to fill it out and have it on file at your school in the event your family experiences job loss, unexpected health care costs, or any other unusual circumstance. Parents who will not be contributing financially to their child’s education should know that it’s still imperative that they help their child complete the FAFSA. Without their parents’ information, students will not be eligible for financial aid. Remember, completing the FAFSA in no way obligates you to pay for college.Steps for Completing the FAFSA

Filling out the FAFSA used to be a long, arduous process. Thankfully, several years’ worth of updates have resulted in a shorter, more streamlined form. The Department of Education outlines the ease of completing the FAFSA through an eight-step process.Collect necessary materials and create an account.

The FAFSA requires documentation of financial circumstances, so you will need specific forms, like your federal tax returns. You’ll also need to create an account on StudentAid.gov to get started. You can set your account up before October 1.Start the FAFSA.

Log in to your studentaid.gov account and click “Start the Form” under the FAFSA section of the site. If you are entering information on your child’s behalf, remember that they must consent, approve, and sign the form in the final step. Be sure the information they input matches what you have filled out. Pro Tip: It may be helpful to fill this section out together!Complete the “Student Personal Finances” section.

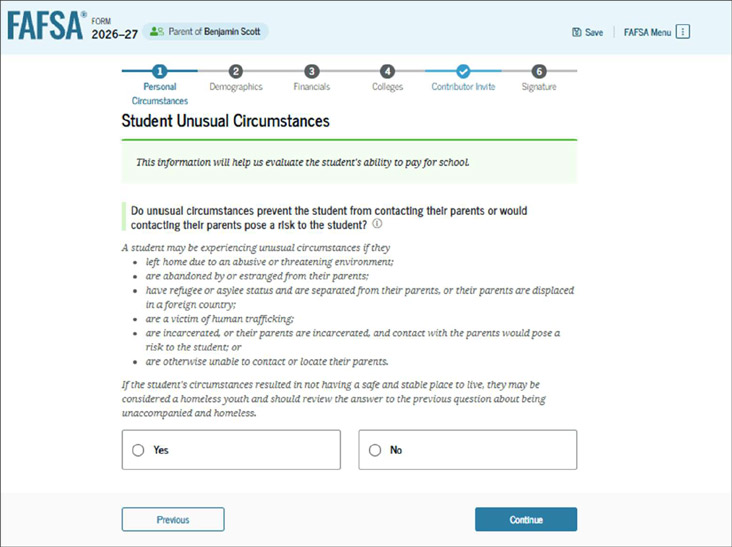

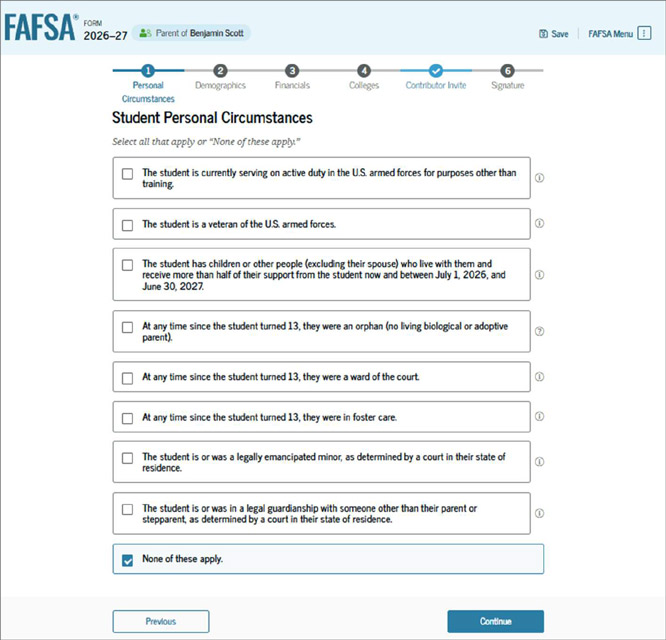

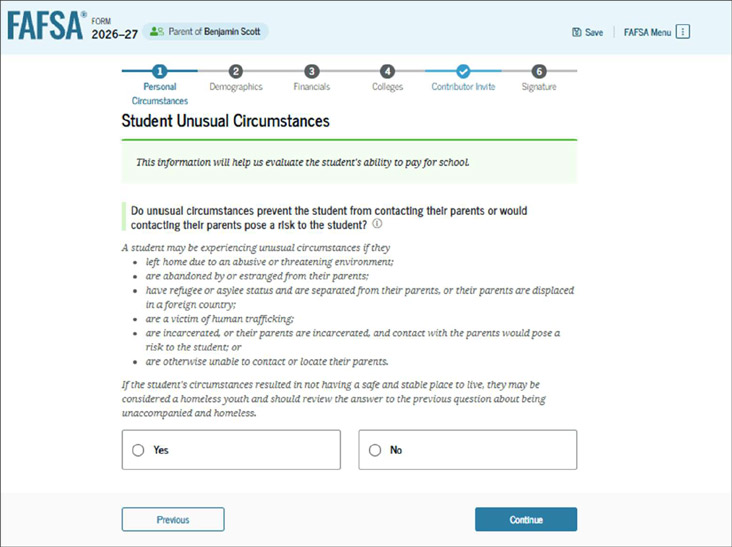

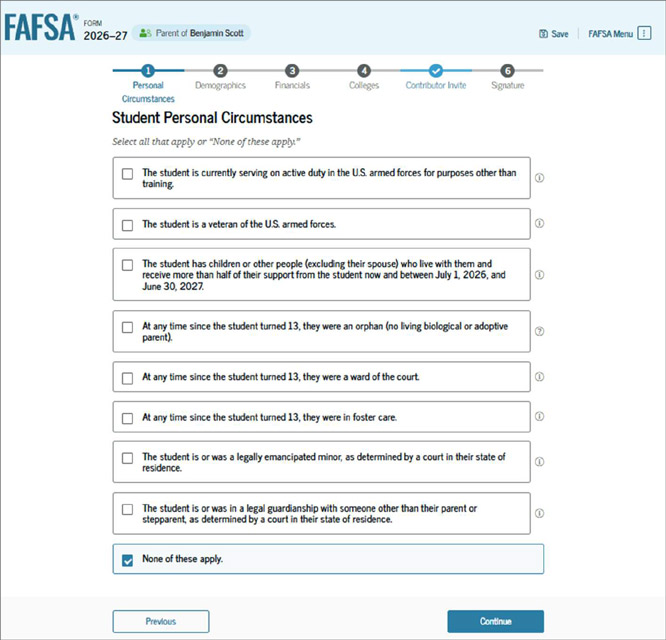

Next, you will answer questions about your child’s current circumstances to determine if they will be viewed as dependent or independent on the FAFSA. The form will also ask questions about whether the child is homeless or exhibits any unusual financial circumstances. If your child is designated as a dependent, your information will be required on the FAFSA; if they are independent, the FAFSA will require only their information. Note: The FAFSA’s specifications for dependent vs. independent on the FAFSA are different from those of the IRS. It is much harder for a student to qualify as an independent on the FAFSA.

Provide consent and approval.

At this point, you will move on from the student to the parent section. Here, you will consent and approve for the IRS to input your financial information directly into the FAFSA form. You are also consenting to sharing your financial information with colleges and universities as well as state governments that you select, so that they can determine an aid package for your child. Note: Reminder, providing your consent and approval does not obligate you to pay for your child’s education. Refusing to provide your financial information will disqualify them from receiving ANY financial aid.Complete the “Parent Demographics” section.

Fill out the Parent Demographics section. This part of the FAFSA focuses mostly on marital status.Complete the “Parent Financials” section.

The simplified FAFSA has made this part easier for parents to complete. Your financial information will be directly input by the IRS. This section of the form will also ask about: • Federal benefits you may have received. • Tax filing status and whether you filed with your spouse. • Number of people in your family. • Number of people in your family who will be enrolled in college in the next academic year. • If you received the Earned Income Credit. • Dollar amount of taxable college grants, scholarships, or AmeriCorps benefits reported as income on the IRS. • Dollar amount of Foreign Earned Income Exclusion. • Child support received. • Total of cash, checking, and savings accounts. • Net worth of investments, including real estate. • Net worth of businesses and investment farms. Pro Tip: Have your 1040 form handy. You may be asked to input financial information from that tax form, too.Sign the form.

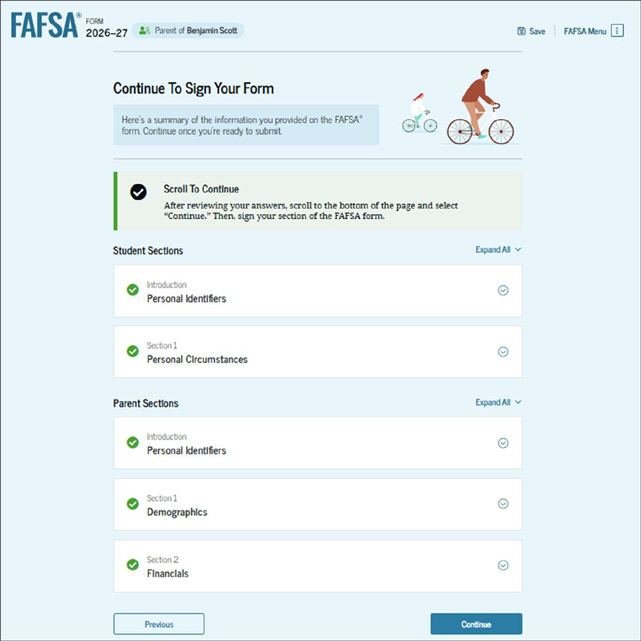

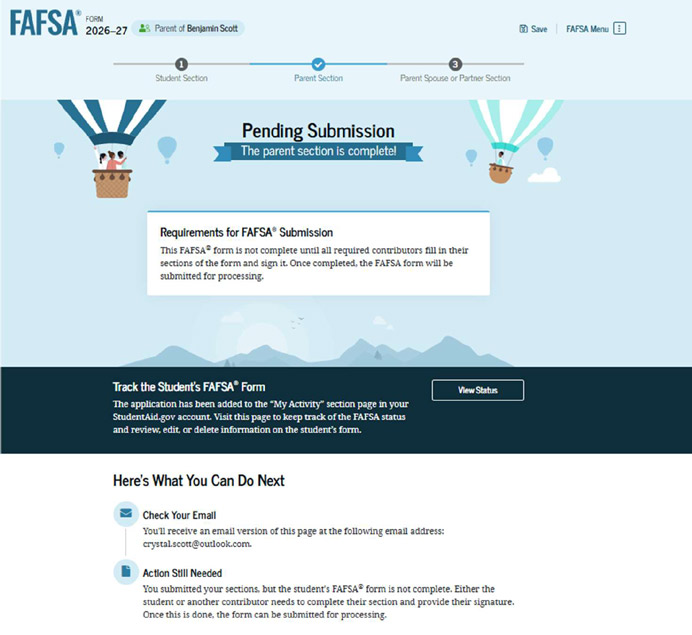

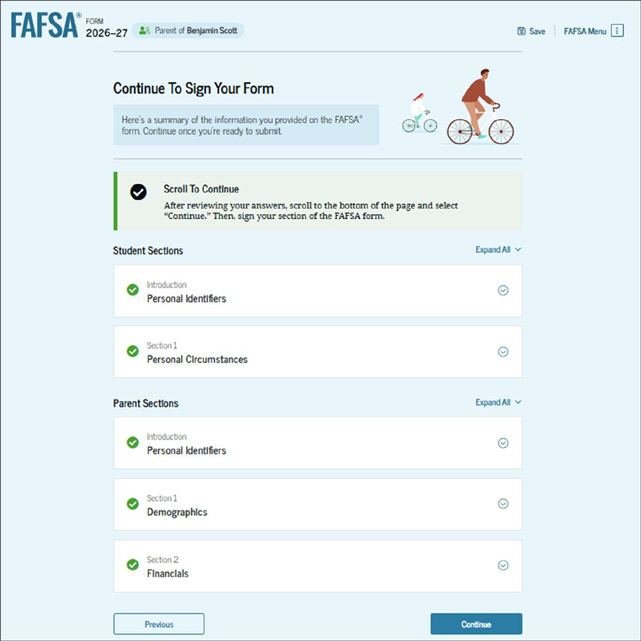

At this point, you will be able to view the information you provided before submitting. If everything is correct, you will sign the form using your StudentAid.gov username and password.

Have your child consent, approve, and sign the FAFSA.

If you started the form for your child, remember that they will have to provide information for the FAFSA to be complete. They will need to fill out the Student Demographics, Student Financials, and Select Colleges and Universities sections. Once this step is complete, they will consent, approve, and sign the FAFSA.

Which Parent Files the FAFSA?

Oftentimes, there are many questions around which parent completes the FAFSA, especially in cases of divorce or separation. Fortunately, this answer has been simplified in recent years as well. If you are married and living together, both parents provide financial information for their child’s FAFSA. If you are unmarried and living together, you will both provide your financial information. Even if you are divorced or separated but living together, both will need to contribute. Finally, if you are divorced or separated and not living together, or you are widowed, the parent who provided the most financial support over the last 12 months will be required to complete the FAFSA. If this parent has remarried, their spouse will also be required to contribute their financial information. If both parents contributed equal financial amounts in the last 12 months, the parent who has the greater income will be responsible for completing the FAFSA.

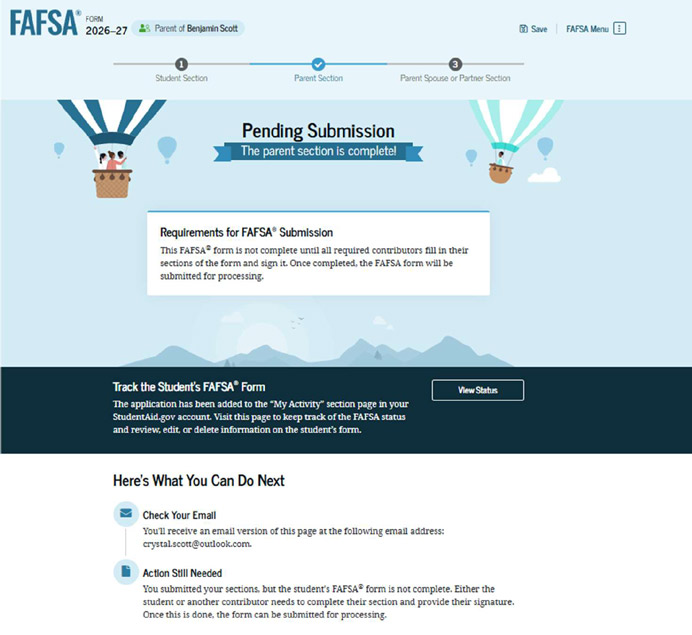

What to Expect on the FAFSA

Crystal Scott, a parent with a senior in high school in the Kansas City suburbs, recently completed the beta testing of the FAFSA that is available now for select student groups and school districts. Her experience completing the FAFSA was much easier and quicker than expected. Her trick? She prepared beforehand. In addition to creating her StudentAid.gov account early, she also downloaded Fastweb’s FAFSA checklist and gathered all the materials necessary. Scott told Fastweb, “I was surprised by how easy and fast it was to complete. It took us about 30 – 35 minutes. The FAFSA beta testing experience was also stable with no unexpected issues. There are "helper text bubbles" for additional support in each step and field of the form, which we did reference in a few places.” Their family did run into an issue concerning unique financial circumstances. However, with a little independent research and a quick call to their accountant, they were able to resolve the issue and submit the FAFSA. While Scott felt like the process of completing the FAFSA was seamless, she did have a few recommendations for her fellow parents: • Have your student use a personal email address to establish their FSA ID account instead of their high school account. They will not be able to access their high school email after graduation, and this FSA ID will be used again in the future. Note: You must complete the FAFSA each year to qualify for aid for the next school year. • Have your child create their FSA ID account first and then create the parent account. • Use the FAFSA checklist to make sure you gather all important information before starting the application, so you don’t have to stop midway through to search for financial information. • If you have unusual circumstances, make sure you take the time to read the information on that step of the form. Then, make a plan for the next steps after completing the FAFSA. If you’re a parent who needs help completing the FAFSA, there are multiple resources available to you. First, you can visit the StudentAid.gov Help section and chat with Aiden, their virtual assistant. You can also chat, email, or call the Federal Student Aid Information Center. Interpreters for 10 different languages are available to assist with conversations in these languages.

Finally, many schools and communities host FAFSA completion workshops. These special days enable students and parents to walk through the form with a FAFSA expert.

If you’re a parent who needs help completing the FAFSA, there are multiple resources available to you. First, you can visit the StudentAid.gov Help section and chat with Aiden, their virtual assistant. You can also chat, email, or call the Federal Student Aid Information Center. Interpreters for 10 different languages are available to assist with conversations in these languages.

Finally, many schools and communities host FAFSA completion workshops. These special days enable students and parents to walk through the form with a FAFSA expert.